Most retail traders lose money trying to pick tops and bottoms. They operate on intuition, feelings, and subjective assessments. They say "Price is too high, it must come down" or "This has dropped too far, it has to bounce." This approach is financial suicide because the market can stay irrational longer than you can stay solvent. Price can always go higher. Price can always go lower. There is no ceiling and no floor that the market is obligated to respect.

Professional traders understand this truth, so they wait for Confirmation. They wait for the market structure itself to shift—from Bullish to Bearish or vice versa—before they ever consider taking a counter-trend position. They don't predict reversals; they confirm them. The Change of Character (ChoCH) is that first structural shift—the earliest objective signal that the trend may be dying.

Understanding ChoCH allows you to exit winning positions near the top (when you see the first warning signs) and enter reversal trades with structural confirmation rather than hopeful guessing. This single concept can transform your trading from gambling to systematic edge exploitation.

1. ChoCH vs. BOS: The Vital Difference

This is the concept that most Smart Money Concept (SMC) beginners confuse, and getting it wrong will lead to taking the wrong side of the market at the worst times. Let's make it crystal clear because this distinction is foundational.

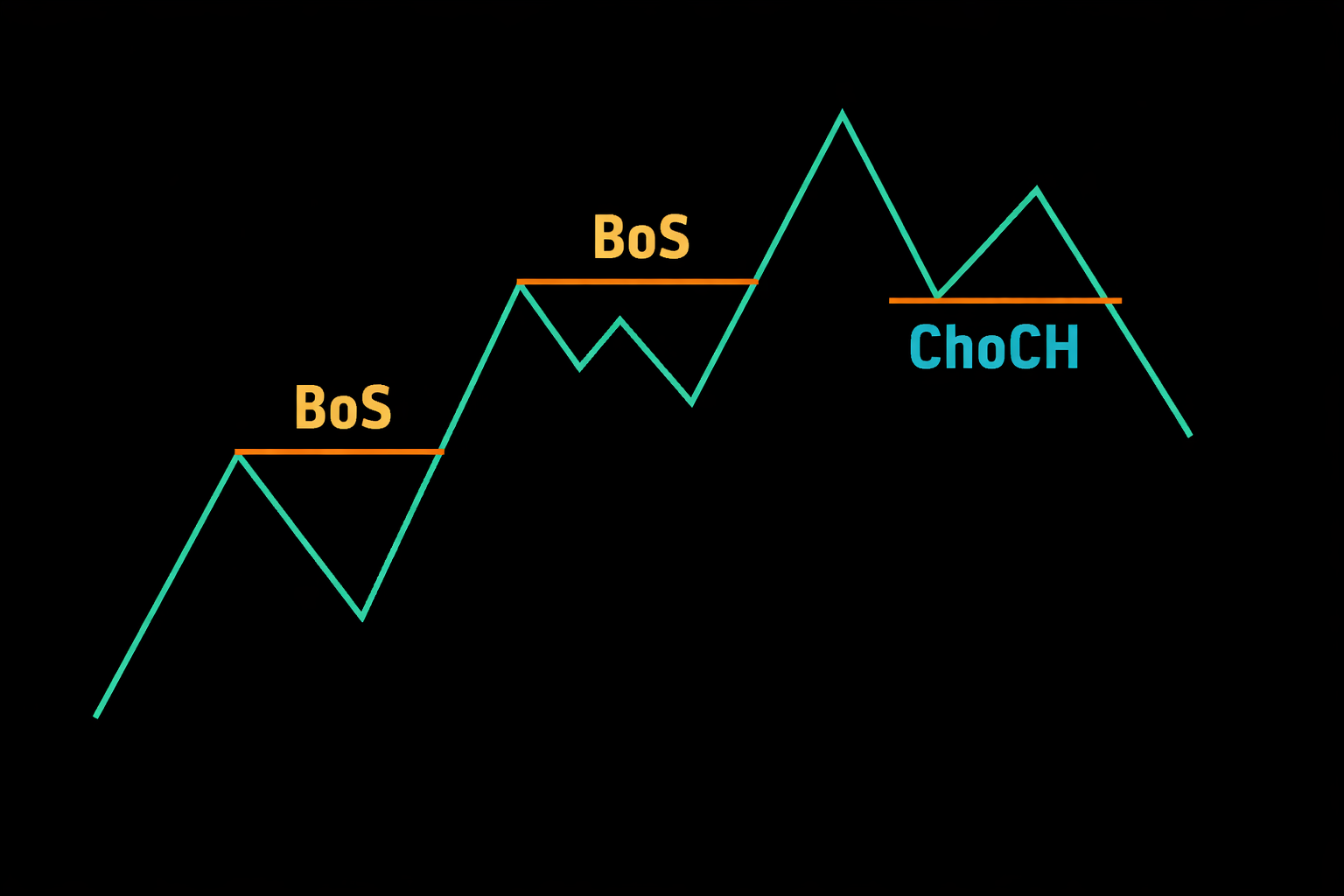

Both BOS and ChoCH are breaks of structure—price trading through a previous Swing Point and closing beyond it. The difference is which direction the break occurs relative to the prevailing trend.

BOS (Break of Structure)

Breaking WITH the Trend.

- In an Uptrend: Breaking above a previous High (making a Higher High).

- In a Downtrend: Breaking below a previous Low (making a Lower Low).

- It means: "The trend is healthy and continuing."

- Action: Keep holding existing positions. Look for trend continuation trades on the next pullback. The path of least resistance remains unchanged.

ChoCH (Change of Character)

Breaking AGAINST the Trend.

- In an Uptrend: Breaking below a previous Low (the sequence of Higher Lows is broken).

- In a Downtrend: Breaking above a previous High (the sequence of Lower Highs is broken).

- It means: "The trend structure is broken or pausing."

- Action: Stop taking trend-following trades. Close or tighten stops on existing positions. Prepare for a potential reversal or extended consolidation.

The simplest way to remember: BOS confirms, ChoCH warns. BOS says "keep going," ChoCH says "something changed."

2. How to Identify a Valid ChoCH

In an Uptrend, the buyers defend the Higher Lows. Think of these lows as the defensive walls of a castle—fortifications that must hold for the kingdom (the uptrend) to survive. Each Higher Low is a new wall, built higher than the last, representing increasing buyer confidence.

As long as the price stays above the Last Higher Low, the buyers are in control. They have successfully defended their territory on every pullback. The trend remains structurally intact regardless of how "overbought" indicators might appear.

The moment a candle CLOSES below the Last Higher Low—not just wicks below, but actually closes below with a candle body—the wall has been breached. The sellers have proven they are stronger than the buyers at that specific moment. For the first time in the uptrend, buyers failed to defend their line. This is a ChoCH—the character of the market has changed.

The same logic applies inversely to downtrends. In a Downtrend, sellers defend the Lower Highs. When price closes above the Last Lower High, the downtrend structure is broken, signaling a potential shift to bullish.

3. The ChoCH Entry Model (Reversal Trade)

How do you actually trade a ChoCH? Do you sell immediately the moment the structure breaks? NO. That is chasing, and chasing leads to poor entries and unnecessary losses. Just like with BOS, the ChoCH is confirmation—not the entry signal itself.

We use the "Return to Origin" model—waiting for price to retrace back to the area that caused the break before entering:

- Identify Context: First, you need a reason to expect a reversal. A ChoCH at a random price level is weak. A ChoCH occurring at a Higher Timeframe Resistance or Supply Zone (e.g., a key Daily or Weekly level where sellers are known to be waiting) is powerful. Context gives the ChoCH significance.

- Wait for the ChoCH: Let the structure actually break on your trading timeframe. Don't anticipate. Don't guess. Wait for the candle body to close below the Higher Low (in a bullish-to-bearish ChoCH) before making any decisions.

- Wait for the Retest: After the ChoCH, price will usually rally back up to test the "crime scene"—the Supply zone or area that caused the break. This rally creates a Lower High (the first Lower High of the new potential downtrend). Smart Money uses this rally to fill their remaining short orders.

- Enter on Confirmation: Look for rejection signals at the retest level—bearish candlestick patterns, failed momentum, or a lower timeframe ChoCH confirming the reversal. Enter Short with your Stop Loss above the Swing High. Target the previous swing low or beyond.

This approach gives you a much safer entry—you're selling a rally rather than chasing a breakdown. You get a tighter Stop Loss (just above the retest high) and better risk-reward compared to guessing the top or chasing the initial drop.

Summary

BOS says "Go." ChoCH says "Stop and reassess." These two concepts are the traffic lights of the market. Mastering the difference allows you to ride trends with confidence (keeping positions while BOS continues), exit your profitable trades near the top (when you see the first ChoCH warning), and enter new reversal positions with structural confirmation rather than hopeful guessing.

Remember: ChoCH is a warning, not a trade. The trade comes on the retest. This patience is what separates the professionals from the crowd who panic at every structural shift and constantly enter at the worst possible prices.