There is no "best" style in trading. A profitable Scalper would likely lose money if forced to be a Position Trader, simply because they would get bored, lose focus, and force trades out of restlessness. Conversely, a patient Swing Trader might get destroyed by scalping because they can't make decisions fast enough.

Your trading style must match your psychology, your schedule, and your temperament. Trying to force yourself into a style that doesn't fit is like forcing a left-handed person to write with their right hand—technically possible, but unnecessarily difficult and ultimately counterproductive.

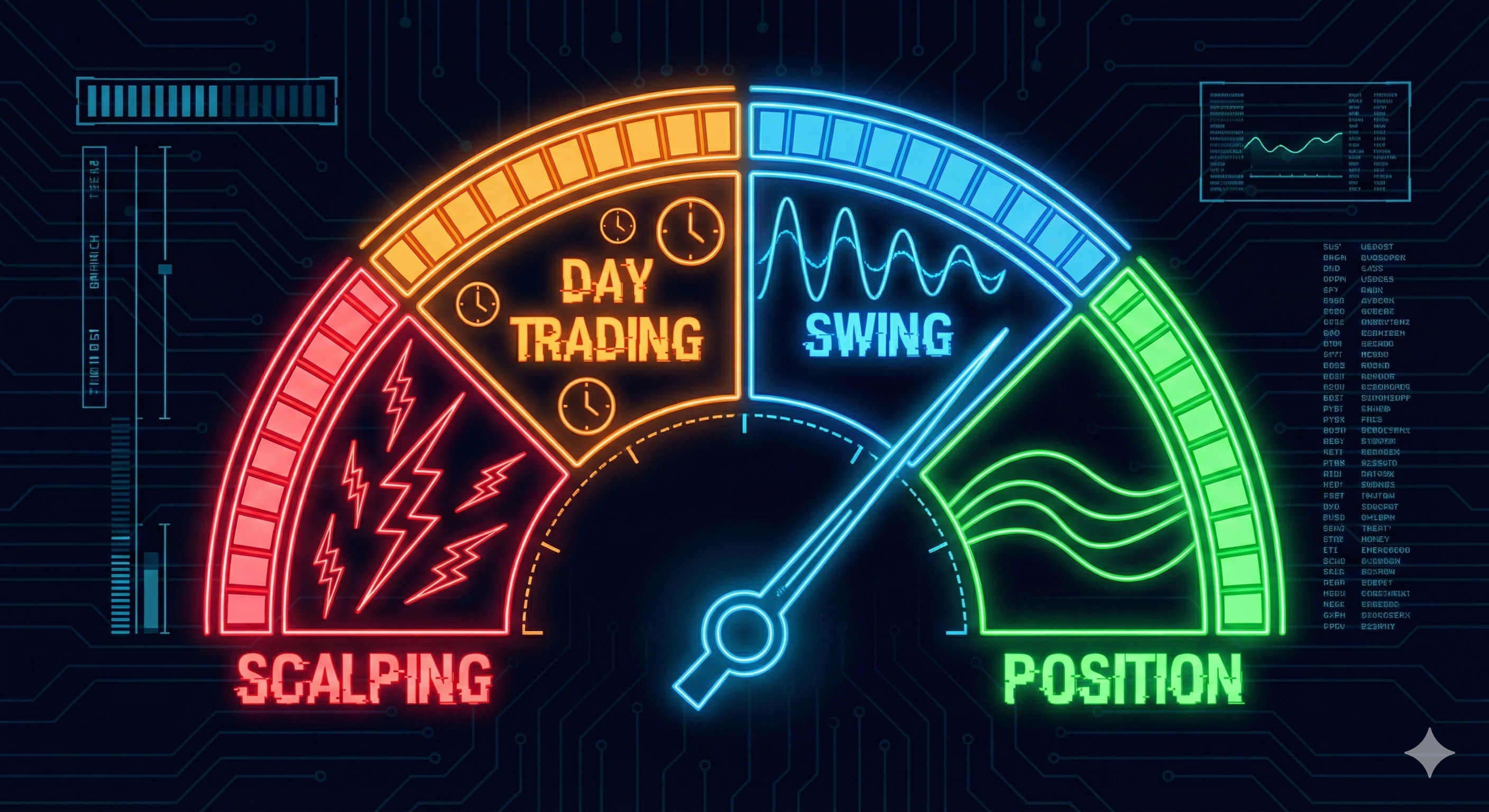

Trading styles are defined by two primary variables: Time Horizon (how long you typically hold a position) and Frequency (how often you trade). Let's break down the four main archetypes so you can identify which one resonates with how your brain naturally works.

1. The Scalper (Formula 1)

Timeframe: Seconds to Minutes (M1, M5 charts).

Frequency: High (10-50 trades/day).

Goal: Capture small moves repeatedly.

The Reality:

Scalping is high-intensity warfare. You are fighting against High Frequency Trading (HFT) algorithms. Your profit margins are thin, meaning commissions and spreads are your biggest enemies. You need to make quick decisions without hesitation.

Lifestyle: You are glued to the screen for 2-3 intense hours. You cannot look away to answer a text. Bathroom breaks can cost you money. It is mentally and physically exhausting.

Who is this for? Adrenaline junkies with fast processing speeds, low-latency internet connections, and the rare ability to accept a loss instantly without emotional baggage. Scalping also requires significant capital because your profit per trade is tiny—you're making money through volume, not magnitude.

Warning: Most retail traders who try scalping fail. They don't have the infrastructure, the reaction speed, or the emotional detachment to compete with algorithmic systems that operate in microseconds.

2. The Day Trader (The Professional)

Timeframe: Minutes to Hours (M15, H1 charts).

Frequency: Medium (2-5 trades/day).

Goal: Catch the main trend of the day.

The Reality:

The Day Trader's golden rule is: No Overnight Risk. You start the day in cash, and you end the day in cash. You sleep perfectly because no news event can hurt you while you dream.

Lifestyle: You treat it like a work shift. You trade the London Open (3 AM EST), the New York Open (9:30 AM EST), or another consistent session window. After your session, you close all positions and are done for the day. No checking prices at dinner, no waking up at 3 AM to see if your trade is okay.

Who is this for? People who want to trade for a living but value their sleep and mental health. Day traders can completely disconnect after their session ends, knowing that no overnight gap or surprise news event can hurt them. This clean separation between "work" and "life" is psychologically valuable.

3. The Swing Trader (The Sniper)

Timeframe: Days to Weeks (H4, Daily charts).

Frequency: Low (2-5 trades/week).

Goal: Capture the "meat" of a larger move.

The Reality:

This is the "Sweet Spot" for retail traders. Because you look at higher timeframes, there is less "noise" and random fluctuation. Technical patterns are cleaner. You have hours to plan a trade, not seconds.

Lifestyle: Low stress. You check charts in the morning before work and in the evening after dinner. You can maintain a full-time job, family responsibilities, and hobbies without any conflict.

Who is this for? People with day jobs, students, parents, or anyone who wants trading to be a meaningful secondary income stream without sacrificing their existing life. Swing trading is also excellent for beginners because the slower pace gives you time to think, analyze your mistakes, and improve without the pressure of split-second decisions.

4. The Position Trader (The Architect)

Timeframe: Weeks to Months (Weekly, Monthly charts).

Frequency: Very Low (1-2 trades/month).

Goal: Ride massive macro economic trends.

The Reality:

This is closest to investing, but using technical invalidation. It requires immense patience and wide stop losses to survive volatility. You are trading Fundamentals (Macro) more than Technicals.

Who is this for? Wealthy individuals looking to grow capital slowly, or macro-economists who understand the "Big Picture."

The "Noise" Factor

Understand this fundamental rule: The lower the timeframe, the higher the noise.

- On a 1-minute chart, a random buy order from a drunk millionaire, a fat-finger error by a bank clerk, or an algorithm testing liquidity can create a massive candle that looks significant but means absolutely nothing. That is "Noise."

- On a Daily chart, that same order is completely invisible—absorbed into the overall price action like a raindrop in an ocean. What remains is "Signal": the genuine supply and demand forces that actually move markets.

Beginners love low timeframes because they want action, excitement, and quick feedback. Professionals often prefer higher timeframes because they want clarity, reliability, and setups they can actually trust. The irony is that chasing action usually produces worse results than patiently waiting for quality.

How to Choose?

Answer these 3 questions honestly:

- How much time do you have? (Full job = Swing Trading. No exceptions).

- How patient are you? (Impulsive = Day Trading gives quick feedback. Swing might bore you into bad trades).

- How fast can you process information? (Slow processor = Avoid Scalping).