A common tragedy in the financial world is the "Trader" who buys a stock hoping for a quick 10% gain. The price drops 10%. He doesn't sell because taking a loss feels like admitting defeat. It drops another 20%. Now he says, "Well, I guess I'm a long-term investor now."

This is not investing. This is failure management disguised as strategy.

This "Accidental Investor" syndrome destroys more accounts than any market crash. The trader entered with one plan (short-term speculation), failed to execute that plan when things went wrong, and then retroactively invented a new plan (long-term holding) to justify not taking the loss. This is not discipline—it is denial.

To succeed, you must define which game you are playing before you open the position, and you must stick to that game's rules regardless of what happens next. You cannot play football with tennis rules and expect to win. You cannot apply investor logic to a trading position or trading panic to an investment portfolio.

1. The Core Difference: Value vs. Price

The Investor

Focuses on Value.

The investor buys a piece of a business (or asset) because they believe it is undervalued or will grow over years. They want to own the asset.

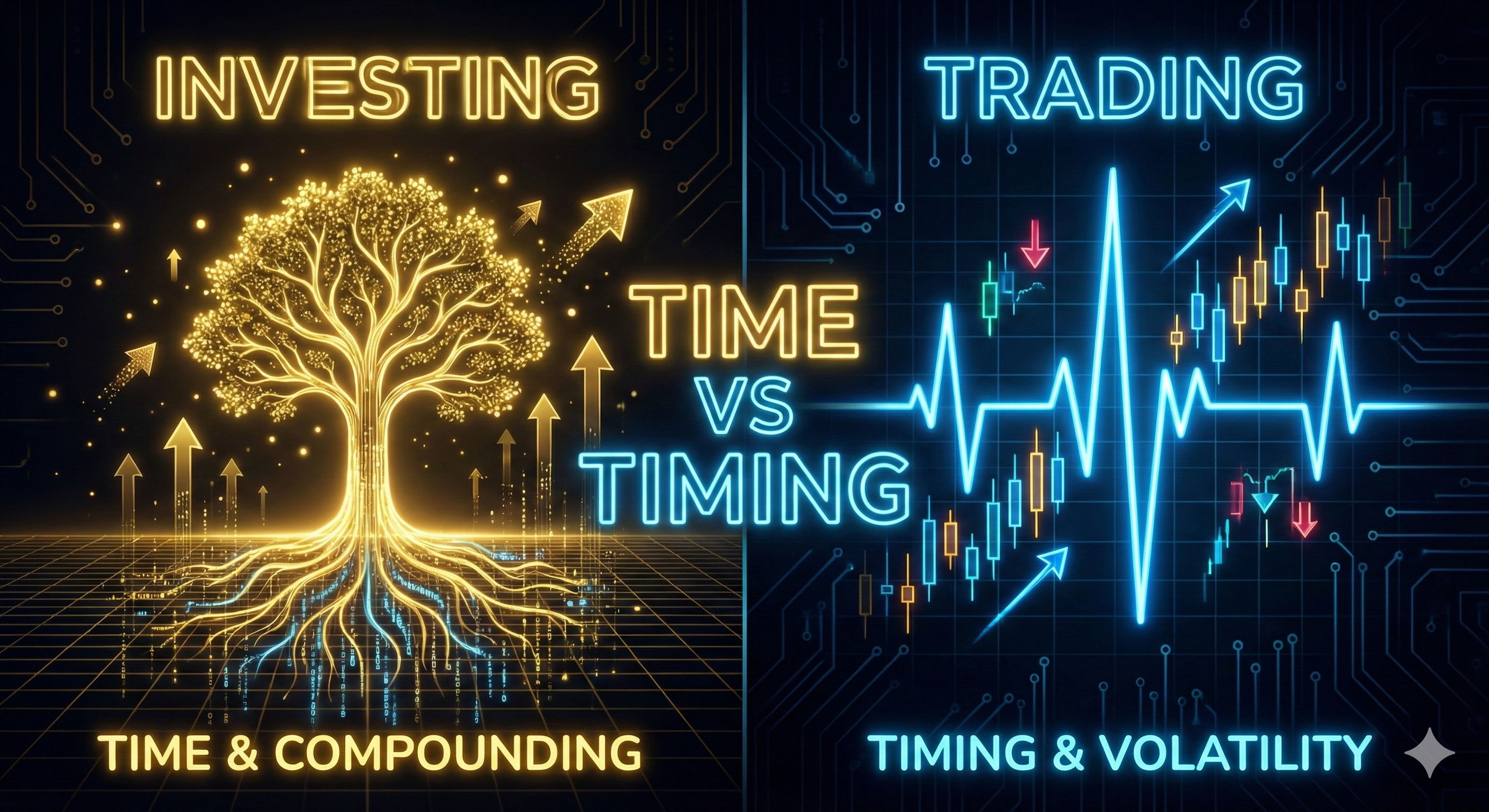

Mantra: "Time in the market beats timing the market."

The Trader

Focuses on Price Action.

The trader doesn't care about the asset's intrinsic value. They care about supply and demand imbalance. They want to rent the price movement.

Mantra: "Buy the rumor, sell the news."

2. How They Handle Risk (The Drawdown)

This is the most critical distinction. How do you react when the price drops 20% against you?

For the Investor: Opportunity

If you love Apple at $150 because you believe the company is fundamentally undervalued, you should love it even more at $120. Nothing about the company changed—it still has the same products, the same cash flow, the same competitive advantages. The only thing that changed is that other people are willing to sell it to you at a cheaper price. For an investor, a price drop is a "sale." They typically use Dollar Cost Averaging (DCA) to buy more during drawdowns. They are willing to endure months or even years of red numbers because their thesis is based on a 5-10 year horizon.

For the Trader: Invalidation

If you bought Apple at $150 because of a technical breakout pattern on the chart—expecting an immediate continuation move to $160—and it drops to $145, your thesis is wrong. The breakout failed. The pattern you relied on did not play out. You must sell immediately to protect your capital for the next opportunity.

A trader who buys more when the price drops is adding risk to a losing position. This is known as "averaging down," and it is the fastest way to blow up a trading account. You are doubling down on a thesis that the market is actively telling you is incorrect. This behavior stems from ego—the refusal to accept being wrong—rather than sound strategy.

3. The Psychology: Dopamine vs. Patience

Investing is meant to be boring. As George Soros said, "If investing is entertaining, if you're having fun, you're probably not making any money." It's like watching paint dry. The best investors often describe their process as "doing nothing"—buying quality assets and then waiting years for compound growth to work its magic.

Trading, by contrast, is high-dopamine. It is intense, fast, and requires constant decision-making under uncertainty. The charts move, your money fluctuates, and your brain lights up with each tick. This intensity attracts people who crave excitement, who hate boredom, who want action. And that's precisely the problem.

Professional traders work hard to remove that excitement. They want to be as boring and methodical as a factory worker clocking in for a shift. Excitement leads to impulsivity. Impulsivity leads to mistakes. The trader who gets a rush from a big win is the same trader who takes revenge trades after a loss. The goal is emotional neutrality—executing your system with the same calm detachment regardless of whether you're up or down.

4. The Real Estate Analogy

To visualize this better, look at the property market:

The Investor is the Landlord

He buys an apartment to rent it out for 20 years. He ignores the daily fluctuation of property prices. He cares about cash flow and long-term appreciation.

The Trader is the House Flipper

He buys a house because he sees an inefficiency (it's undervalued, needs paint, or the market is hot). He wants to sell it in 3 months for a profit. If the market crashes, he sells quickly to protect his capital. He does not want to live in the house.

Can you be both?

Yes, absolutely. In fact, most wealthy people are. Warren Buffett is primarily an investor, but he also made directional bets on currencies and commodities. Many hedge fund managers maintain personal long-term portfolios separate from their active trading operations.

You can have a long-term retirement portfolio (Investing) where you buy index funds, blue-chip stocks, or real estate and never sell—regardless of short-term volatility. And you can have a separate active account (Trading) where you speculate on daily or weekly moves with strict risk management and defined exit points.

The secret is to keep them completely separate. Different accounts, different rules, different mindsets. Never let them mix. When you're looking at your investment portfolio, you're an investor—patient, calm, unconcerned with daily noise. When you're looking at your trading account, you're a trader—disciplined, quick to cut losses, focused on execution.

The moment you start applying trading logic to your investments (panic selling during a correction) or investment logic to your trades (holding a losing position because "it will come back"), you are guaranteed to lose money. Keep the mental walls firm between these two activities.