Imagine you are a surfer sitting in the Pacific Ocean. You cannot control the ocean. You cannot decide when a wave comes, how big it will be, whether it will barrel perfectly or crash chaotically, or if a shark is swimming beneath you. If you try to command the ocean—if you scream at it to give you the perfect wave—you will exhaust yourself and eventually drown.

However, you have enormous control over yourself. You control your board choice, your paddle timing, your balance, your physical fitness, your positioning in the lineup, and which waves you choose to pursue versus which ones you let pass. The great surfers aren't great because they control the ocean. They're great because they've mastered everything within their control while accepting everything outside of it.

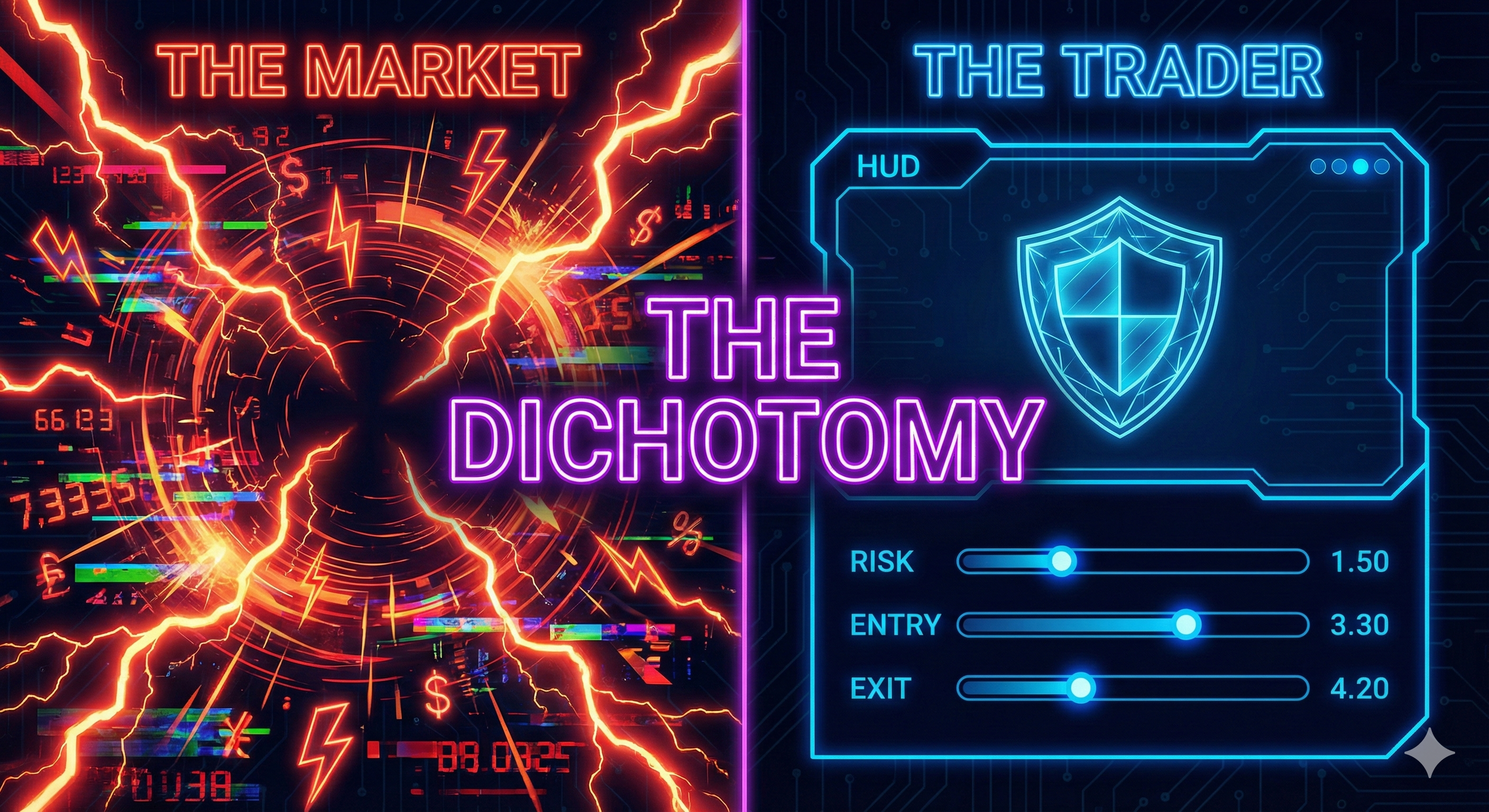

Trading is surfing. The market is the ocean. Your job is not to control the waves—it's to ride them skillfully.

1. The "Cannot Control" List (The Ocean)

Most beginners waste 90% of their mental energy worrying about these factors. It is energy wasted on the impossible.

🚫 Totally Out of Your Control

- The Outcome of THIS Trade: Once you click buy, it is out of your hands. You can manage it, but you cannot force it to hit Take Profit.

- Price Movement: You cannot stop the price from dropping. Screaming at your screen changes nothing.

- News & Events: Elon Musk tweeting, the Fed raising rates, a war starting. These are external shocks.

- Liquidity: Whether there is someone willing to buy what you are selling.

If you attach your self-worth to these things, you will be miserable. You will feel "betrayed" by the market every time it moves against you. But the market didn't betray you; it just moved.

2. The "Can Control" List (The Surfer)

This is where your job description lives. A professional trader focuses 100% of their attention here. If it's not on this list, they ignore it.

✅ 100% Under Your Control

- 1. Risk per Trade: You decide exactly how much money you are willing to lose before entering.

- 2. Entry Timing: The market invites you, but YOU pull the trigger. You can always say "No."

- 3. Exit Strategy: You decide where your Stop Loss goes. You decide when to take profits.

- 4. Your State of Mind: Are you tired? Angry? Drunk? Distracted? You control whether you sit at the desk.

- 5. Preparation: Did you mark your levels? Did you read the news calendar?

3. The Illusion of Control

Beginners instinctively try to compensate for their lack of control over outcomes by adding complexity to their analysis. It feels proactive. It feels like doing something.

They think: "If I add 5 more indicators, I will control the outcome better. If I watch 3 more timeframes, I'll see what's really happening. If I study more patterns, I'll finally crack the code."

No. You are just adding noise. You are trying to predict tomorrow's weather by installing 50 thermometers instead of 1. More data doesn't give you more control over the future—it just gives you more ways to confuse yourself and hesitate.

The Paradox: The more you try to control the market (prediction, complexity, overthinking), the less control you have over yourself (emotion, discipline, execution). Conversely, the more you surrender control of the market (accepting uncertainty, embracing simplicity), the more control you gain over yourself (calm execution, consistent process).

This is why the best traders often have the simplest systems. They've stopped fighting for control they can never have. They've redirected all that energy into perfecting what they actually can control.

4. A Practical Exercise: The "Did I?" List

After every trading session, do not ask: "Did I make money?"

Instead, ask these questions. If the answer is YES to all, you had a successful day, regardless of the PnL.

If you check all these boxes and lose money, you did your job perfectly. The market just didn't pay you today. Come back tomorrow.

Conclusion: Process Over Outcome

Stop fighting the ocean. You will never win that battle. Learn to surf instead.

When you focus only on your process—the things genuinely within your control—something remarkable happens. Anxiety disappears. You are no longer responsible for whether the trade wins or loses. You are only responsible for whether you followed your rules. That's a burden you can actually carry.

Did you wait for your setup? Check. Did you calculate proper position size? Check. Did you place your stop immediately? Check. Did you follow your exit plan? Check. If you checked all those boxes, you had a successful trading day—regardless of whether you made or lost money.

Over time, if your system has an edge and you execute it consistently, the money follows. But the money is a byproduct, not the goal. The goal is perfect execution of your process. That is true freedom. That is how professionals think.