If you take nothing else from this entire guide, take this concept. Burn it into your memory. Tattoo it on your forearm if you have to. This is the mathematical secret that allows a trader to survive decades in the market while others blow up in their first month.

You do not need to be smart. You do not need to be right most of the time. You do not need a PhD in finance or a supercomputer running algorithms. You just need to understand one concept: Positive Expectancy. Once you grasp this, everything else in trading becomes clearer.

1. The Golden Equation

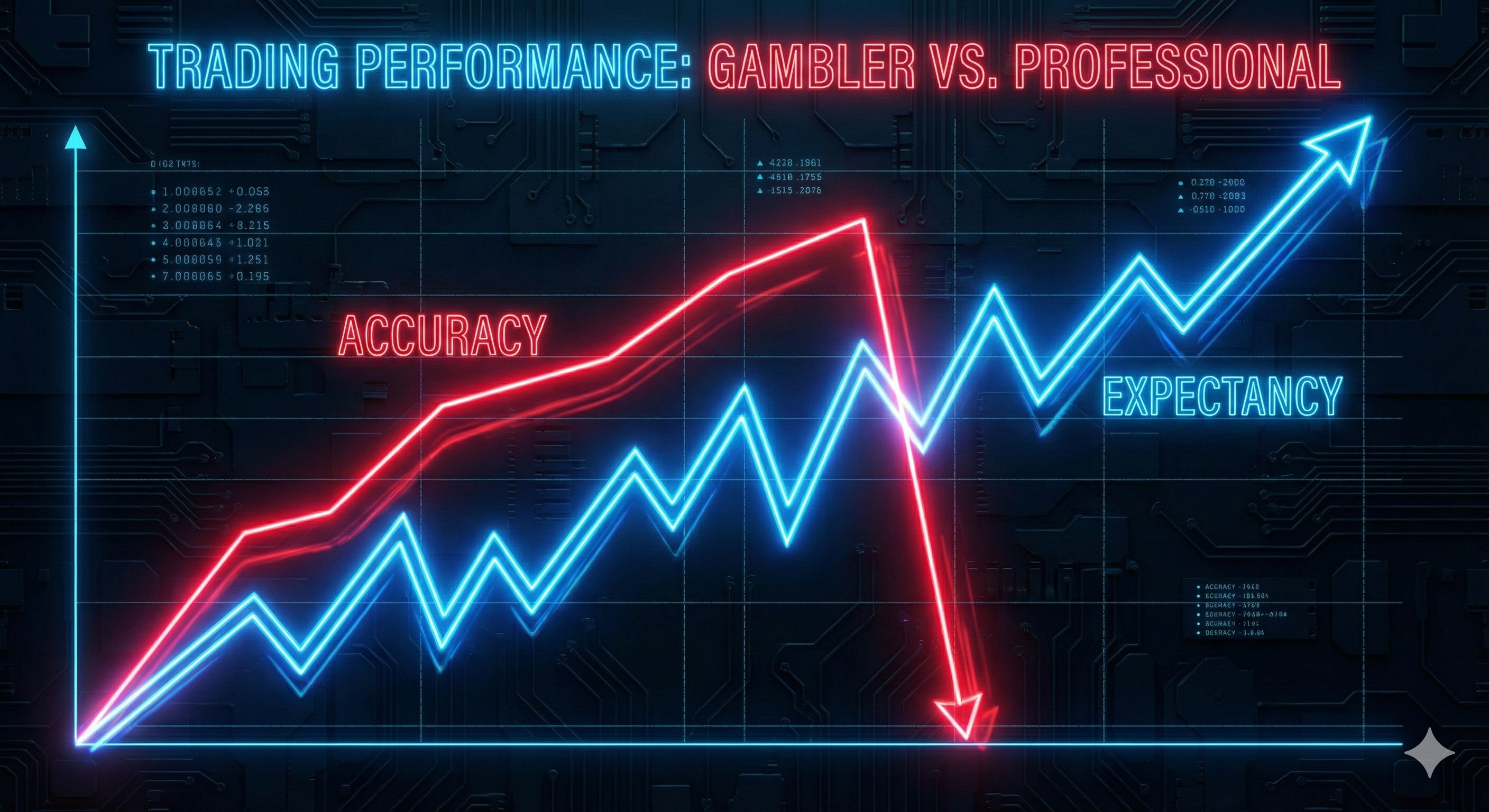

Profitability is not defined by your Win Rate (how often you win). It is defined by the relationship between your Win Rate and your Risk:Reward Ratio.

Expectancy = (Win % x Avg Win) - (Loss % x Avg Loss)

If the result is positive, you have a business. If it is negative, you have a hobby that costs money.

Let's simulate two traders to prove why "being right" is overrated.

Trader A: "The Ego Trader"

He hates losing. He takes profits quickly to "secure the win" but lets losses run hoping they come back.

- Win Rate: 70%

- Avg Win: $50

- Avg Loss: $150

- Expectancy per trade: -$10

Trader B: "The Casino"

She doesn't care about being right. She cuts losses fast and lets winners run to targets.

- Win Rate: 40%

- Avg Win: $200

- Avg Loss: $100

- Expectancy per trade: +$20

Look at this carefully. Trader A wins 7 times out of 10—a 70% win rate that sounds amazing—and loses money. Trader B is wrong 6 times out of 10—a 40% win rate that sounds terrible—and builds wealth consistently.

The difference is simple: Trader A protects his ego (needs to be "right") while Trader B protects her capital (needs to survive). Stop trying to be Trader A. The market will eventually crush any ego-driven approach. Learn to love being wrong on individual trades while being right on the math.

2. The Law of Large Numbers

Imagine you have a winning coin toss strategy with a 55% win rate. If you flip the coin 5 times, you might get 5 Tails in a row. This feels like the strategy is broken. It feels like you're doing something wrong. But you're not—this is called "variance," and it's completely normal.

If you flip that same coin 1,000 times, the 55% edge will manifest. It's mathematically guaranteed. The variance smooths out. The short-term noise becomes long-term signal. This is the Law of Large Numbers, and it's the foundation of every casino, insurance company, and professional trading operation on Earth.

Here's the problem: most retail traders judge their strategy on the last 3 trades. They get 3 losses in a row (totally normal variance) and panic. They conclude the strategy is broken. They switch to something else. They never let the Law of Large Numbers work for them.

To succeed, you must think in blocks of 20-50 trades minimum. Not individual trades. Here's what a profitable sequence might actually look like:

- Trade 1: Loss (-1R)

- Trade 2: Loss (-1R)

- Trade 3: Loss (-1R)

- Trade 4: Win (+2R)

- Trade 5: Loss (-1R)

- Trade 6: Win (+3R) — Big winner

- ...

- Trade 20: Net Profit (+8R)

If you changed your strategy after Trade 3 because "it wasn't working," you would have missed the big winners that made the whole sequence profitable. You restart the process, reset your sample size to zero, and never reach the mathematical edge. This is why system-hopping kills traders.

3. Risk:Reward Ratio (R:R)

This is your primary weapon. R:R defines how much you risk vs. how much you plan to make.

If you risk $100 to make $200, your R:R is 1:2. This means you only need to be right 33% of the time to break even.

| Risk:Reward | Breakeven Win Rate | Profit at 50% Win Rate |

|---|---|---|

| 1 : 1 | 50% | $0 (Fees will kill you) |

| 1 : 2 | 33% | Huge Profit |

| 1 : 3 | 25% | Massive Profit |

At The Traders' Light, we generally look for setups offering at least 1:2 or 1:3. We don't take 1:1 trades because they require us to be too accurate.

Thinking Like the House

When a casino loses a $10 million jackpot on a slot machine, the floor manager doesn't panic. He doesn't fire anyone. He doesn't change the rules of the game. He doesn't shut down the machine.

Instead, he smiles, writes the check, takes a photo with the winner for PR, and offers them a free suite and dinner. Why is he so calm after losing $10 million?

Because he knows the math. He knows that the slot machine has a 5% house edge. He knows that over the next 100,000 spins, that machine will generate far more than $10 million in profit. The jackpot was just a cost of doing business—a cost that keeps players coming back and spinning.

Be the House. Develop your edge through a tested strategy. Execute that edge consistently without deviation. Accept the individual losses as business expenses—the cost of finding the wins. Don't panic after a losing streak. Don't celebrate after a winning streak. Just execute, day after day, and let the math compound in your favor.

That's how casinos became billion-dollar empires. That's how you become a profitable trader.