If you ask a doctor how long it took to become a surgeon, they will say: "10 years of training after college."

If you ask a commercial pilot, they will say: "1,500 flight hours minimum, usually 3-5 years."

If you ask a lawyer, they will say: "7 years of education plus years of practice."

If you ask a new trader how long they expect profitability to take, they often think: "Maybe 3 months? 6 months max?"

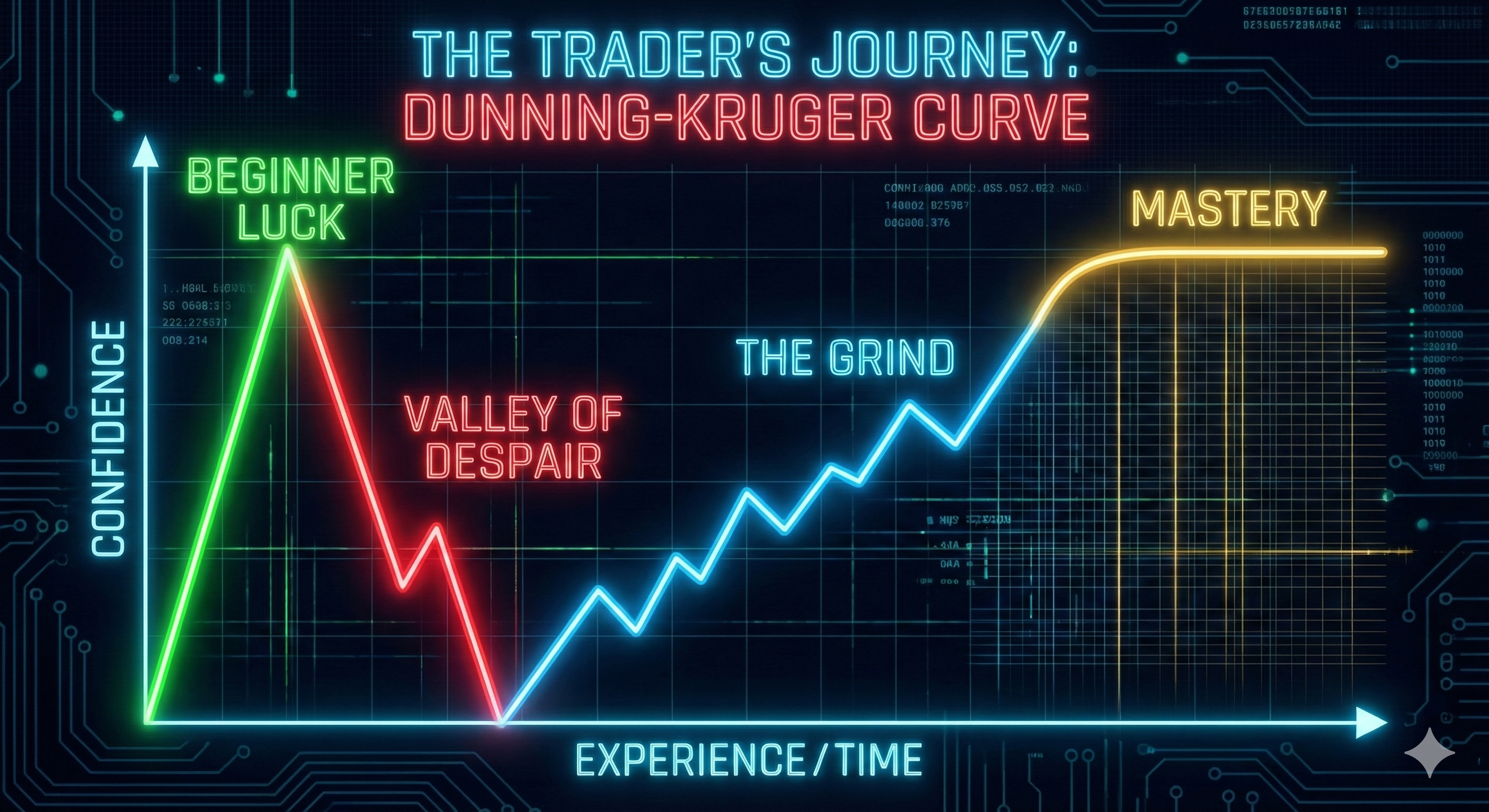

This expectation gap is the primary killer of trading accounts—not bad strategies, not lack of capital, not market manipulation. People quit because they expected a sprint and found themselves in a marathon. They expected linear progress and got a brutal, non-linear learning curve.

Trading is a high-performance skill. Like playing concert violin, competing in chess at the grandmaster level, or performing surgery, it follows a specific psychological learning curve. Understanding this curve before you start gives you a massive advantage: you won't quit when things get hard, because you'll know it's supposed to get hard.

Phase 1: The Dreamer (Unconscious Incompetence)

Timeline: Months 1-3

You just discovered trading. You saw some screenshots of massive gains on social media. You watched a few YouTube videos. You open a demo account (or worse, a real account), place a few random trades, and maybe you win some money. Your brain floods with dopamine. You think: "This is easy! Why doesn't everyone do this? I'll be rich by Christmas."

This is "Beginner's Luck"—and it's the most dangerous phase. You don't know what you don't know. You're taking massive risks without realizing it because you haven't experienced the consequences yet. You're standing on a minefield, blindfolded, thinking you're dancing at a party.

The wins feel like skill. They're actually random variance that happens to be going your way. When the variance flips—and it always does—you'll have no idea what hit you.

- Primary Danger: Blowing up your entire account in one catastrophic week.

- Secondary Danger: Early wins creating false confidence that leads to even bigger losses later.

Phase 2: The Valley of Despair (Conscious Incompetence)

Timeline: Months 3-12 (sometimes longer)

Reality hits—hard. The lucky streak ends. You start losing consistently. You try to fix it by changing strategies every week, buying expensive indicators, joining paid Discord groups, watching endless hours of YouTube tutorials. Nothing seems to work. Every "solution" creates new problems.

You realize trading is brutally hard. Much harder than anyone told you. You feel stupid, frustrated, and increasingly desperate. The market seems to be personally targeting you—moving against you the moment you enter, hitting your stop loss to the pip before reversing.

This is where 90% of people quit forever. The pain becomes too much. The financial losses mount. The psychological toll affects other areas of life. They conclude "trading doesn't work" or "it's rigged" and walk away, often bitter and broken.

But here's the truth: this phase is absolutely necessary. It is the fire that burns away your ego, your delusions, your get-rich-quick fantasies. Only by hitting rock bottom do you become humble enough to actually learn. If you survive this valley, you start asking the right questions. Instead of "How do I get rich fast?", you ask "How do I stop losing? How do I survive?"

Phase 3: The Grind (Conscious Competence)

Timeline: Years 1-3

You have a strategy that you've tested and trust. You have written rules that you follow. You use a Stop Loss on every single trade without exception. You manage your risk properly. But... you're not rich yet. You're hovering around "Breakeven"—maybe slightly profitable, maybe slightly negative.

You win some, you lose some. Month after month, you're basically working for free or for pennies. This is the boring phase. There's no excitement. No massive wins to screenshot. No stories to tell at parties. Most thrill-seekers quit here because the adrenaline that attracted them to trading is completely gone.

But this is secretly where the magic happens. You are building the most valuable asset a trader can have: data about your own performance. You are rewiring your brain to execute without emotion. You are developing the muscle memory of discipline. You are becoming a professional, even if your account balance doesn't show it yet.

The traders who survive this phase—who can tolerate months or years of "boring" breakeven performance—are the ones who eventually break through to consistent profitability. Patience here is everything.

Phase 4: Mastery (Unconscious Competence)

Timeline: Year 3+ (varies significantly)

You sit down at your desk. You scan your charts. You see a setup that matches your criteria. You calculate position size. You enter. The trade loses. You feel almost nothing—maybe a slight acknowledgment, like noticing it's cloudy outside. You see another setup. You enter. It wins big. You feel almost nothing—maybe a small nod of satisfaction.

Trading has become as routine and emotionally neutral as brushing your teeth. You know your edge works over hundreds of trades. You don't stress about individual outcomes because you manage risk perfectly and trust the math. A losing week doesn't shake your confidence. A winning month doesn't inflate your ego.

Paradoxically, now that you genuinely don't care about the money on any individual trade, the money starts flowing in consistently. Your detachment from outcomes is precisely what allows you to execute flawlessly. You have achieved what you originally sought: freedom. Not just financial freedom, but freedom from the emotional chaos that destroys most traders.

Your Goal for This Guide

Let's be realistic about what education can and cannot do. We cannot make you a Master (Phase 4) by reading articles. That requires screen time, real trades, real emotions, and real experience that no course can substitute.

Our goal at The Traders' Light is more modest but more achievable:

- Get you out of Phase 1 safely, without blowing up your account on beginner mistakes

- Guide you through Phase 2 without going bankrupt or quitting in despair

- Equip you with the technical tools, risk management frameworks, and psychological foundations to endure Phase 3

The journey from Phase 1 to Phase 4 typically takes 2-5 years of dedicated practice. That might sound discouraging, but consider: 2-5 years to potentially achieve financial freedom for the rest of your life is an incredible return on investment. Most people spend 40 years working jobs they hate. You're building a skill that could set you free.

If you are ready to do the work—not the fantasy of easy money, but the actual grinding work of becoming a professional—then let's start building your technical knowledge. Welcome to the real journey.

Part 0 Complete. Ready for the next step?

Start Part 1: What Is Trading