If you walked into a hospital operating room with zero training, watched a 10-minute YouTube video, and tried to perform heart surgery, you would fail. Everyone understands this. No one expects to become a surgeon overnight. Yet, this is exactly how most people approach the financial markets.

They deposit money (often money they can't afford to lose) into a brokerage account, watch a few tutorials, and start clicking buttons. They enter an arena dominated by hedge funds with billion-dollar research budgets, algorithms that execute in microseconds, and professionals with decades of experience. And they expect to win immediately.

The result is predictable: they lose. But here's the important part—they don't lose because they're stupid. They lose because they're unprepared. This page is your reality check. If you can understand why others fail, you can engineer your own survival.

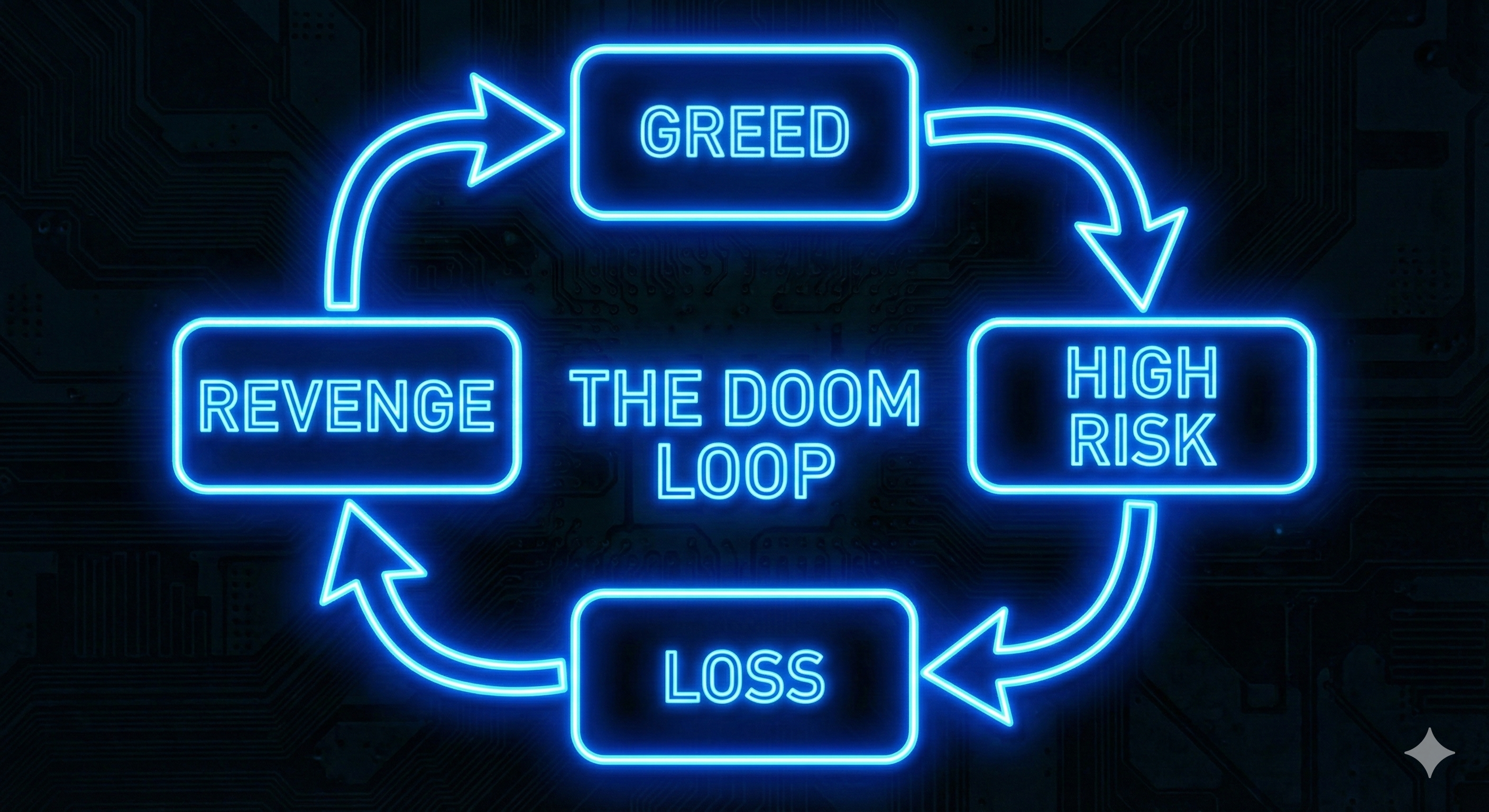

1. The "Doom Loop" (Psychology)

Failure in trading is rarely a straight line down. It's not a single bad decision that wipes you out (usually). Instead, it's a cycle—a vicious loop fueled by human emotion that repeats until there's no money left. The scary part is that almost every failing trader follows the exact same pattern, as if reading from a script:

- Unrealistic Expectations: You want to double your account in a month. You've seen screenshots online. You think it's normal.

- Oversizing: To achieve that unrealistic goal, you risk 10% or 20% per trade instead of the professional standard of 1%. You need big wins fast.

- The Inevitable Loss: You take a hit. Maybe two. Your account drops 30% or 40% in a few days. The math of recovery is now brutal.

- The Emotional Damage: You feel stupid, angry, or desperate. Your ego is bruised. You need to "make it back" to prove you're not a failure.

- Revenge Trading: You re-enter the market immediately, with bigger size and zero plan. You're not trading the chart anymore—you're trading your emotions. This is the death blow.

The cycle then repeats. More losses, more desperation, more oversized bets. Within weeks, the account is gone. The trader either quits forever, convinced "trading doesn't work," or deposits more money and repeats the exact same mistakes.

2. Mathematical Suicide (Risk Management)

Most beginners obsess over Strategy—when to buy, which indicator to use, what pattern to look for. They spend 95% of their time on entry signals. Meanwhile, they completely ignore Risk Management—how much to risk on each trade, how to size positions, how to survive losing streaks. This is a fatal error.

The cold reality is that even the best strategy in the world will have losing streaks. Five losses in a row happens to everyone. Ten losses in a row happens more than you'd think. The question is: when that losing streak hits, are you still in the game?

Let's look at the math of recovery. If you lose a portion of your capital, how much do you need to make back just to break even?

| Loss % | Required Gain to Break Even | Difficulty |

|---|---|---|

| -10% | +11% | Manageable |

| -20% | +25% | Hard |

| -50% | +100% | Extremely Difficult |

| -90% | +900% | Impossible |

This table reveals the brutal asymmetry of losses. A 50% drawdown requires a 100% gain to recover. That means you need to double your remaining capital just to get back to where you started. For most traders, that's psychologically and practically impossible.

When you risk too much (e.g., 5% or 10% per trade), a simple losing streak of 4 or 5 trades—which happens to even the best traders in the world—puts you in a 40-50% drawdown. You're now in a hole so deep that the math is against you. Even if you suddenly become a perfect trader, recovery will take months or years.

Winning traders risk small (0.5% to 1% per trade) specifically so they can survive the inevitable losing streaks. After 5 losses at 1% risk, you're down only 5%. You're still in the game. You can think clearly. You can execute your plan. That's the difference between survival and extinction.

3. System Hopping

This is the "Shiny Object Syndrome" of trading, and it destroys more potential than almost any other mistake.

Here's how it works: A beginner tries a strategy (e.g., Support & Resistance). He loses 3 trades in a row. Instead of analyzing why—maybe the market was ranging, maybe he entered too early, maybe his stop was too tight—he immediately concludes: "This strategy sucks. I need a better one."

He goes to YouTube, finds a video titled "99% Win Rate Secret Indicator," tries it for a week, loses again, and switches to Smart Money Concepts. Two weeks later, he's studying Elliot Waves. Then Wyckoff. Then algorithmic trading. Then back to indicators. The cycle never ends.

"If you dig 100 holes that are 1 foot deep, you will never find water. You must dig one hole that is 100 feet deep."

No strategy works 100% of the time. Read that again. No strategy works 100% of the time. Every system, no matter how good, has losing periods. These are called drawdowns, and they are completely normal. The strategy you abandoned after 3 losses might have gone on to produce 10 winners in a row—but you weren't there to see it.

Professionals stick to their system through the losses because they've tested it, they trust the math, and they know that edge only materializes over a large sample of trades. Amateurs quit right before the winning streak starts, perpetually resetting their learning curve to zero.

4. Lack of Data (No Journal)

Imagine a CEO who never looks at his company's financial reports. He doesn't know which products sell, which ones lose money, what his margins are, or where the cash is going. He makes decisions based on gut feelings and hunches. That CEO would be fired within a week.

Yet most traders run their "business" exactly this way—with zero data.

Ask yourself honestly:

- Do you know your exact Win Rate over the last 50 trades?

- Do you know your Average Risk:Reward ratio?

- Do you lose more money on Mondays or Fridays? During London session or New York?

- Are you better at Longs or Shorts?

- Which setup makes you the most money? Which one loses?

- How often do you break your own rules?

If you can't answer these questions with real numbers, you are gambling. You cannot improve what you do not measure. You cannot fix leaks you don't know exist.

A trading journal is the mirror that shows you your mistakes with brutal clarity. It reveals patterns you can't see in the moment—that you always revenge trade after lunch, that you always exit winners too early, that you always overtrade on Fridays. It is painful to look at, which is exactly why losers avoid it. Winners embrace the discomfort because they know it's the only path to improvement.

How to be in the 10%

The path to becoming a profitable trader is not about finding a magic algorithm. It is about inverting the failure habits:

- Focus on "How much money can I make?"

- Change strategy every week.

- Risk random amounts based on feelings.

- Blame the market / Elon Musk / The Fed.

- Never journal.

- Focus on "How much money can I lose?"

- Master ONE setup perfectly.

- Risk strictly 0.5% - 1% per trade.

- Accept responsibility for every click.

- Journal obsessively.

Survival is your first priority. Growth is second. If you can simply not blow up your account for 12 months, you are already better than 90% of the people who try this.