Before diving into technical analysis, market structure, or liquidity strategies, we need to clean house. Trading is probably the hardest way to make "easy money." It is an elite profession that demands Olympic-level discipline, emotional control, and a willingness to accept uncomfortable truths about yourself.

To succeed with The Trader's Light, you must first "unlearn" what popular culture has taught you. Social media is flooded with images of luxury cars, exotic vacations, and traders flashing six-figure account balances. What you don't see is the years of struggle, the blown accounts, and the psychological toll that comes before any of that becomes real.

This chapter is your foundation. If you skip it, everything else you learn will be built on sand. Here is the raw reality of what trading is not.

1. Trading is Not a Casino (Gambling)

The distinction between a trader and a gambler is often blurry for beginners. The gambler seeks adrenaline, action, the "big hit." He bets on red or black hoping to get lucky. He chases the dopamine rush of a winning spin, and when he loses, he doubles down hoping to recover.

In trading, if you feel excitement or intense fear with every click, you are gambling. You are not working. The emotional rollercoaster—euphoria after a win, despair after a loss—is the signature of a gambler, not a professional.

The casino has an "Edge" (a mathematical advantage) over the player. On any single spin of roulette, the casino might lose. But over thousands of spins, the math guarantees they win. In trading, your goal is to become the Casino, not the player. You do not bet on uncertainty; you exploit repetitive probabilities over a large sample size.

A professional trader is a cold, calculating risk manager. He doesn't look to "beat" the market, but to execute a plan where the probabilities are slightly in his favor, over and over again. He feels almost nothing when he wins, and almost nothing when he loses. Each trade is just one data point in a long series of outcomes. This emotional neutrality is what separates the 10% who survive from the 90% who blow up.

2. It is Not a Fixed Monthly Salary

This is the hardest concept to accept for those coming from the corporate world. As an employee, you trade your time for money. 1 hour of work = X dollars. You show up, you do your tasks, and at the end of the month, money appears in your bank account. It's predictable, stable, and safe.

In trading, there is zero correlation between time spent and money earned.

This fundamental truth destroys most beginners psychologically. They feel entitled to profits because they "worked hard" studying charts all week. But the market doesn't care about your effort. It only cares about whether you were right or wrong at that specific moment in time.

The Employee Mindset

You can spend 50 hours analyzing charts this week and still lose money. You can read 10 books on trading and still blow your account. Hard work does not guarantee payment. Effort does not equal results.

The Performance Mindset

You can spend 2 hours, take one perfect trade, and make your month. Or you can wait three days without trading because there's no setup. You are paid for quality decisions, not attendance. Patience is work.

Some months will be exceptional (+10%), others will be flat (0%), and some will be negative (-2%). This variance is normal and expected. The professional trader plans for it by keeping living expenses separate from trading capital. If you need money to pay rent tomorrow, do not trade. Financial pressure forces bad decisions. It makes you take setups that aren't there. It makes you hold losers hoping they'll come back. Financial desperation is the absolute guarantee of failure.

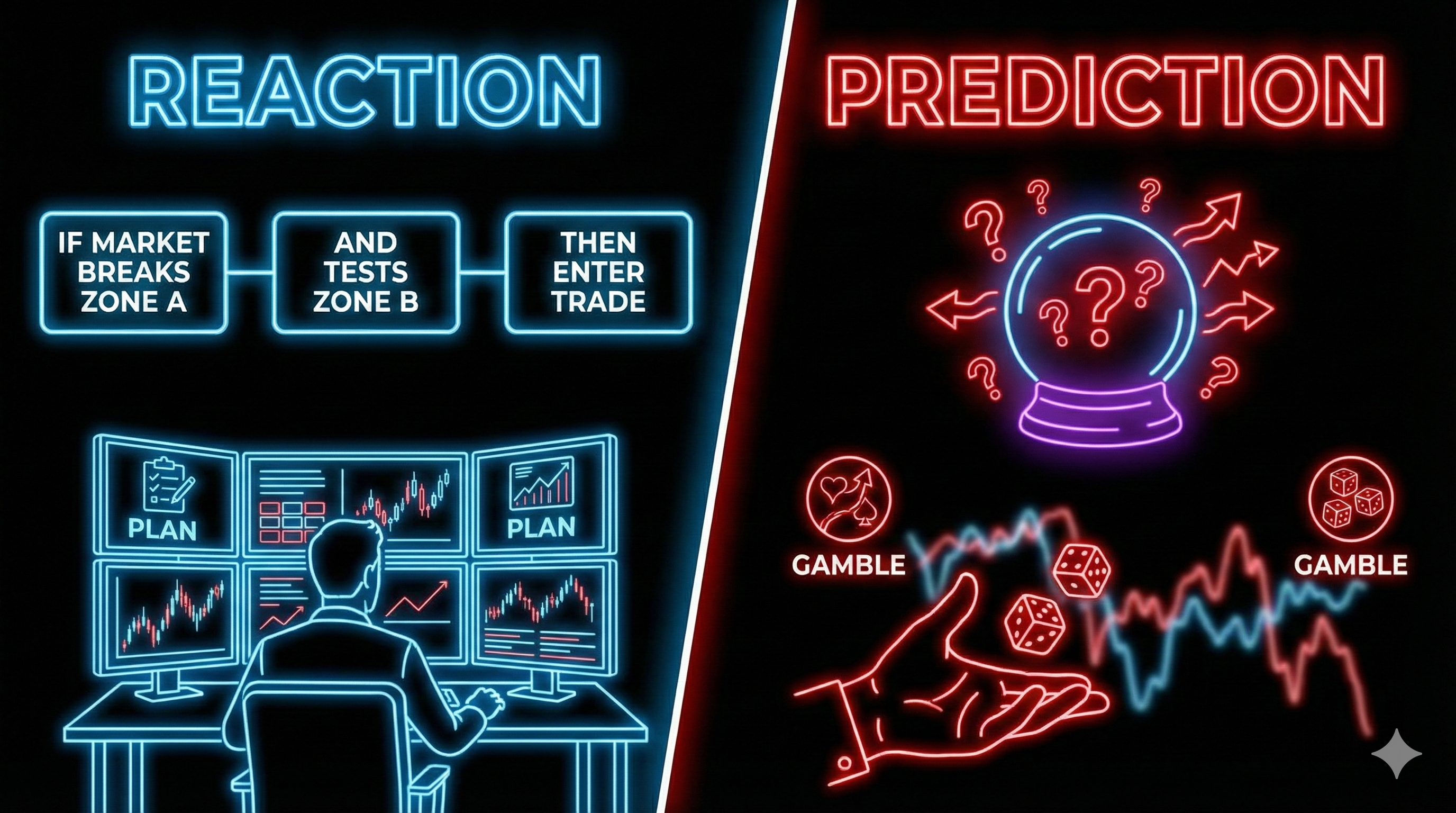

3. It is Not a Prediction Game

Ask an amateur what he does, and he will say: "I try to guess if EUR/USD will go up."

Ask a professional, and he will say: "I have identified a reaction zone. IF price reacts this way, I enter. IF NOT, I do nothing."

This distinction is subtle but absolutely critical. The amateur is trying to predict the future. He wants to know what will happen. The professional has accepted that the future is unknowable. Instead, he prepares for multiple scenarios and reacts to what actually happens.

We are not meteorologists. We don't have a crystal ball. We are reactors, not predictors.

Trading consists of building "IF... THEN..." scenarios. Before the market opens, you already know what you're looking for:

- IF the price breaks the H4 structure,

- AND it comes back to test the demand zone,

- AND I see a bullish rejection candle,

- THEN I execute my plan with defined risk.

If those conditions don't appear, you do nothing. You don't force a trade because you're bored or because you "feel" like the market should go up. It doesn't matter what you think or what you want. Only what the market does matters. Your opinions are irrelevant. Your feelings are noise. Price is truth.

4. It is Not an Intellectual Competition

There is a persistent myth that you need to be a math genius or have a PhD in economics to trade successfully. This couldn't be further from the truth. In fact, highly intelligent people often fail at trading precisely because they try to "solve" the market like a complex equation.

The market is not a puzzle to be solved. It's a dynamic, chaotic system driven by millions of participants with different goals, timeframes, and information. No amount of intelligence can predict what millions of humans will do next.

"Complexity is the enemy of execution."

The more indicators you add to your chart—RSI, MACD, Bollinger Bands, Ichimoku, Fibonacci extensions, pivot points—the more confusion you create. When five indicators say "buy" and three say "sell," what do you do? You hesitate. You second-guess. You enter late or not at all. This is called "Analysis Paralysis," and it kills more traders than bad strategies ever will.

At The Trader's Light, we advocate a clean approach. We read price, structure, and volume. We use one or two confirmation tools at most. A simple system executed with iron discipline will always beat a complex system executed with hesitation. The goal is not to be the smartest person in the room. The goal is to be the most consistent.

So, what is it actually?

If trading is not gambling, not a salary, not prediction, and not an IQ test, then what is it?

Trading is a Risk Management Business.

Think of yourself as the CEO of a small company. Imagine you run a clothing store:

- Your Capital is your inventory—the shirts, pants, and shoes sitting on your shelves.

- Your Losses are your operating costs—rent, electricity, unsold merchandise you have to discount.

- Your Wins are your revenue—every item sold at a profit.

No store owner expects every single item to sell at full price. Some products flop. Some seasons are slow. That's normal. The business survives because the owner controls costs, manages inventory wisely, and ensures that winners outweigh losers over time.

Your only job as a trader is identical: ensure your operating costs (losing trades) remain low and controlled, while maximizing your best-sellers (winning trades). You don't need to be right all the time. You don't need to predict the future. You just need to survive long enough for your edge to play out over a large sample of trades.

This mental shift—from "trader" to "business owner"—changes everything. You stop taking losses personally. You start seeing them as the cost of doing business. And that's when real progress begins.