Imagine throwing a ball into the air. As it travels upward, it slows down. At the very peak, before it starts to fall, its speed is zero. Even though it is higher than it was a second ago, its momentum has vanished.

This is exactly what a **Bearish Divergence** is. The price makes a Higher High (the ball is higher), but the Oscillator makes a Lower High (velocity is dropping). Gravity is about to take over.

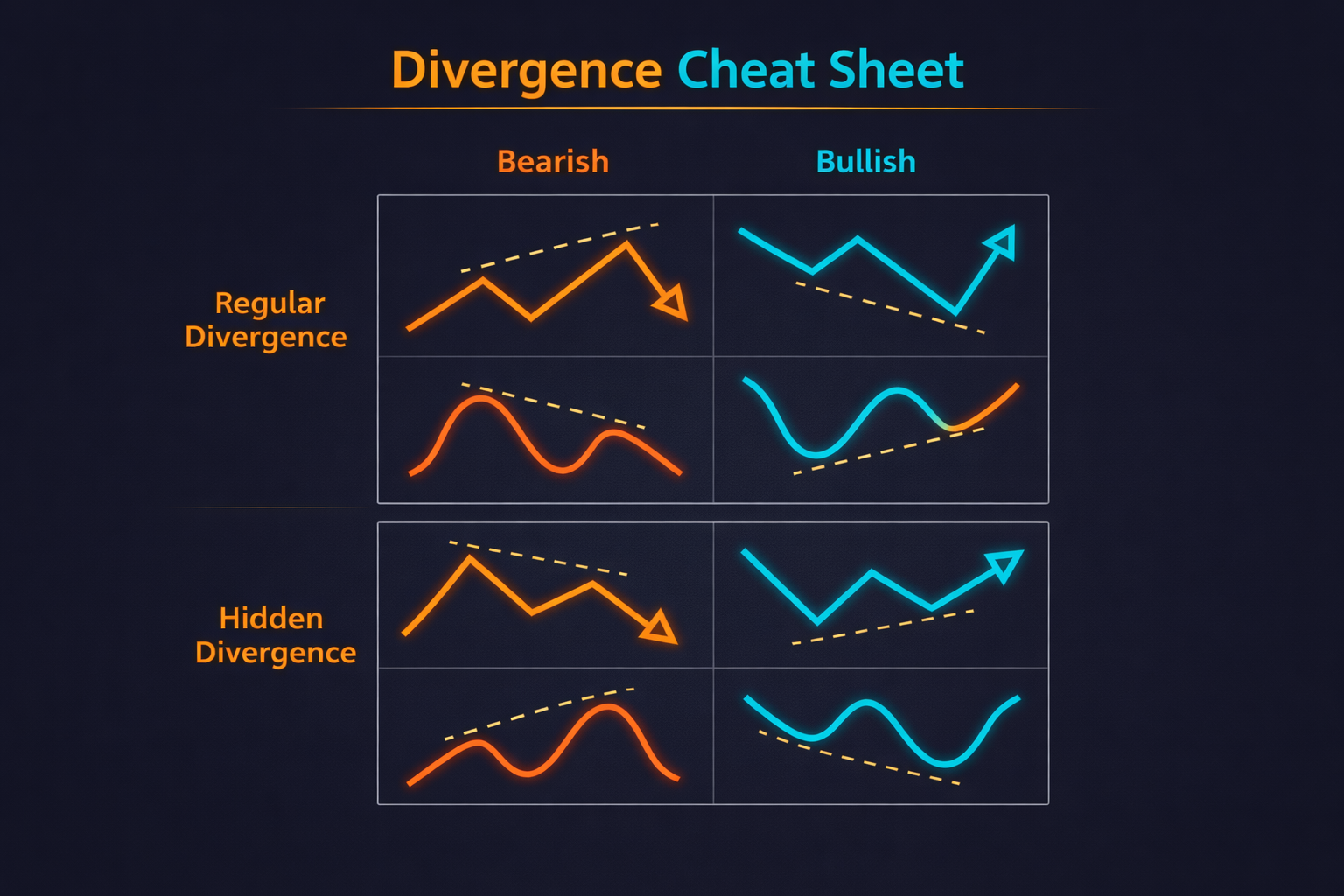

1. Regular Divergence (The Reversal)

Regular divergence is used to spot the End of a Trend. It is a counter-trend signal.

Bearish Regular

- Price: Higher High (HH)

- Indicator: Lower High (LH)

- Meaning: Buyers are exhausted.

- Action: Prepare to Sell.

Bullish Regular

- Price: Lower Low (LL)

- Indicator: Higher Low (HL)

- Meaning: Sellers are exhausted.

- Action: Prepare to Buy.

2. Hidden Divergence (The Continuation)

This is the secret weapon of professional traders. While everyone else is looking for a reversal, Hidden Divergence tells you the trend is just resting and will continue.

Bearish Hidden

- Trend: Downtrend.

- Price: Lower High (LH).

- Indicator: Higher High (HH).

- Meaning: Indicator overreacted to a small price bump. Trend is strong. Sell the rally.

Bullish Hidden

- Trend: Uptrend.

- Price: Higher Low (HL).

- Indicator: Lower Low (LL).

- Meaning: Indicator got oversold, but price held up well. Buy the dip.

3. The Divergence Trap (Parabolic Trends)

This is how traders blow accounts. In a parabolic trend (like Bitcoin going vertical), you will see Bearish Divergence happen 3, 4, or 5 times in a row... and price keeps going up.

Why? Because strong momentum can "reset" the oscillator without price dropping. The indicator cools off sideways, then pumps again.

4. The 3-Point Confirmation Checklist

To trade a Regular Divergence safely, wait for these three things:

- The Divergence: The indicator clearly disagrees with price at a key Higher Timeframe Level.

- The Structure Break (ChoCH): Price breaks the recent Higher Low (for a short). This proves the momentum loss has transferred to price.

- The Entry: Enter on the retest of that break.

If you enter before step 2, you are guessing.

Summary

Divergences are powerful because they reveal the internal health of the market. Regular Divergences help you exit at the top. Hidden Divergences help you re-enter the trend. Master them, and you will never be caught on the wrong side of momentum again.